Tips for Making The Most Of Benefits and Decreasing Expenses With Your Health Insurance Coverage Plan

Browsing health and wellness insurance coverage can frequently really feel frustrating, yet understanding the details of your plan is critical for making best use of benefits and minimizing prices. Additionally, leveraging preventative services can be a calculated step to mitigate future wellness issues without sustaining extra expenses.

Understand Your Plan Details

Navigating the complexities of your health insurance coverage strategy is crucial to maximizing its benefits and preventing unanticipated prices. A comprehensive understanding of your plan information can dramatically influence both your monetary wellness and accessibility to needed medical care solutions.

Pay close focus to the network of companies consisted of in your strategy. In-network suppliers commonly offer services at reduced rates, minimizing additional costs. Understanding which healthcare centers and specialists become part of your network can protect against shock expenditures from out-of-network charges. Establish which services need pre-authorization to avoid potential claim rejections.

Acquaint yourself with the specifics of your plan's protection, including any type of exclusions or restrictions. Specific services or therapies may not be covered, necessitating alternative remedies. Furthermore, recognize the yearly out-of-pocket maximum; reaching this limitation can cause considerable financial savings, as the insurance firm covers 100% of subsequent expenses.

Use Preventive Providers

Taking benefit of preventative services can be a game-changer in preserving your wellness and taking care of healthcare expenses properly. Most wellness insurance plans are mandated to cover precautionary solutions without calling for a copayment or deductible.

Routine screenings for conditions such as high blood pressure, diabetes, and cancer can bring about very early treatments, reducing the need for more complex and expensive treatments later on. Additionally, preventive care often includes therapy on way of life modifications, such as cigarette smoking cessation and weight administration, which can substantially affect long-lasting health and wellness outcomes. Staying informed about the specific preventative solutions covered under your plan and scheduling them as recommended is crucial.

In addition, participating in preventative care fosters an aggressive strategy to wellness administration, empowering individuals to make enlightened choices regarding their wellness - Health insurance agency Houston. By prioritizing preventative services, you can optimize your medical insurance advantages while adding to a much healthier life

Select In-Network Providers

When you get treatment from an out-of-network supplier, you risk sustaining considerably greater expenses, as these service providers have actually not agreed to the insurance policy company's reduced prices. Typically, insurance policy plans cover a smaller sized percent of the fees or, sometimes, none whatsoever. This can bring about unexpected and significant clinical bills.

To ensure you are selecting in-network click to find out more carriers, utilize your insurance plan's on the internet directory site or contact client service for a comprehensive checklist of participating health care specialists and centers. Frequently examining your network standing is advisable as company networks might transform. By continually going with in-network care, you will efficiently handle health care prices, guaranteeing your funds are made use of efficiently while preserving accessibility to needed clinical solutions.

Testimonial and Compare Alternatives

Recognizing the numerous wellness insurance policy choices offered to you needs diligence and attention to detail. Navigating the medical insurance landscape requires a thorough strategy to evaluating the myriad of plans offered by various carriers. Begin by analyzing your medical care requires, thinking about factors such as age, case history, and expected usage of healthcare solutions. This fundamental understanding will direct you in identifying strategies that straighten with your individual scenarios.

Do not overlook the importance of network constraints. Plans usually vary in the doctor they consist of, which can influence your access to preferred facilities or doctors. Investigate whether your existing service providers are in-network under the plans you are considering, as this can substantially influence both benefit and cost.

Manage Prescription Prices

Prescription drug costs can quickly gather, making it important to manage these prices successfully. Start by assessing your health and wellness insurance strategy's formulary, which notes covered medicines. Understanding this checklist can aid you determine preferred medications, which frequently feature lower copayments. If your drug is not provided, consult your healthcare copyright about feasible options that are covered.

Generic medicines existing an additional possibility for price financial savings. They have the same site active ingredients as brand-name drugs however are normally far more economical. When visiting your physician, ask about the accessibility of generics for your prescriptions. In addition, make use of mail-order pharmacy services provided by lots of insurance companies. These services typically give a 90-day supply of medication at a minimized price contrasted to regular monthly refills at a retail pharmacy.

For those with recurring drug requirements, consider enrolling in a drug help program. Numerous pharmaceutical firms use these programs to help patients accessibility prescriptions at decreased prices or absolutely free, based on eligibility.

Conclusion

Taking full advantage of the advantages and decreasing the prices of a health insurance coverage plan needs a comprehensive understanding of plan information, consisting of deductibles, co-payments, and in-network companies. Using preventative services without extra expenses assists maintain health Discover More Here and find problems early. Contrasting and evaluating medication options, as well as selecting mail-order prescriptions, can bring about substantial cost savings. Staying informed about pre-authorization needs and in-network solutions guarantees affordable healthcare management, inevitably advertising both monetary and physical health.

Browsing health insurance policy can often really feel overwhelming, yet comprehending the intricacies of your plan is vital for making best use of benefits and decreasing expenses.Navigating the intricacies of your health and wellness insurance strategy is crucial to optimizing its advantages and avoiding unanticipated costs. Many wellness insurance plans are mandated to cover preventative services without requiring a copayment or deductible. Browsing the health insurance coverage landscape requires an extensive technique to evaluating the myriad of strategies provided by various providers.Optimizing the advantages and minimizing the costs of a health and wellness insurance policy strategy calls for a comprehensive understanding of strategy details, consisting of deductibles, co-payments, and in-network suppliers.

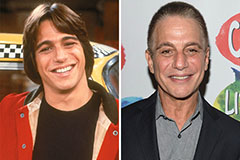

Tony Danza Then & Now!

Tony Danza Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!